There are several others, but at this post let us look at the Wall street. Clearly, those who has their business related to the loans. These companies make money based on much interest income that they can accumulate from the debt. In Accounting, Finance or Business 101 courses, one learns how to calculate the interest income. The higher the amount that a person takes, the more interest expenses that she or he needs to pay. Interest expenses for the person, is equivalent to interest income for the other party.

That having said, potentially the lender of the loan or the loan servicing entities will experience a tremendous pressures on their bottom line. If these organization are selling their stock at Wall Street, then needless to say that whoever own these organizations stock will also experience the pitch.

At this point, the Association would like make thing pretty clear i.e., make a disclaimer of this post. The analyses posted in this site are purely based on logic and economic theory. Will it become a reality? Who knows. Therefore, no one can make any investment decision based on this post, for this writing is not directed to any investment advice nor do AAEA has any interest to bad mount anyone or any entity such as NNI or NVI.

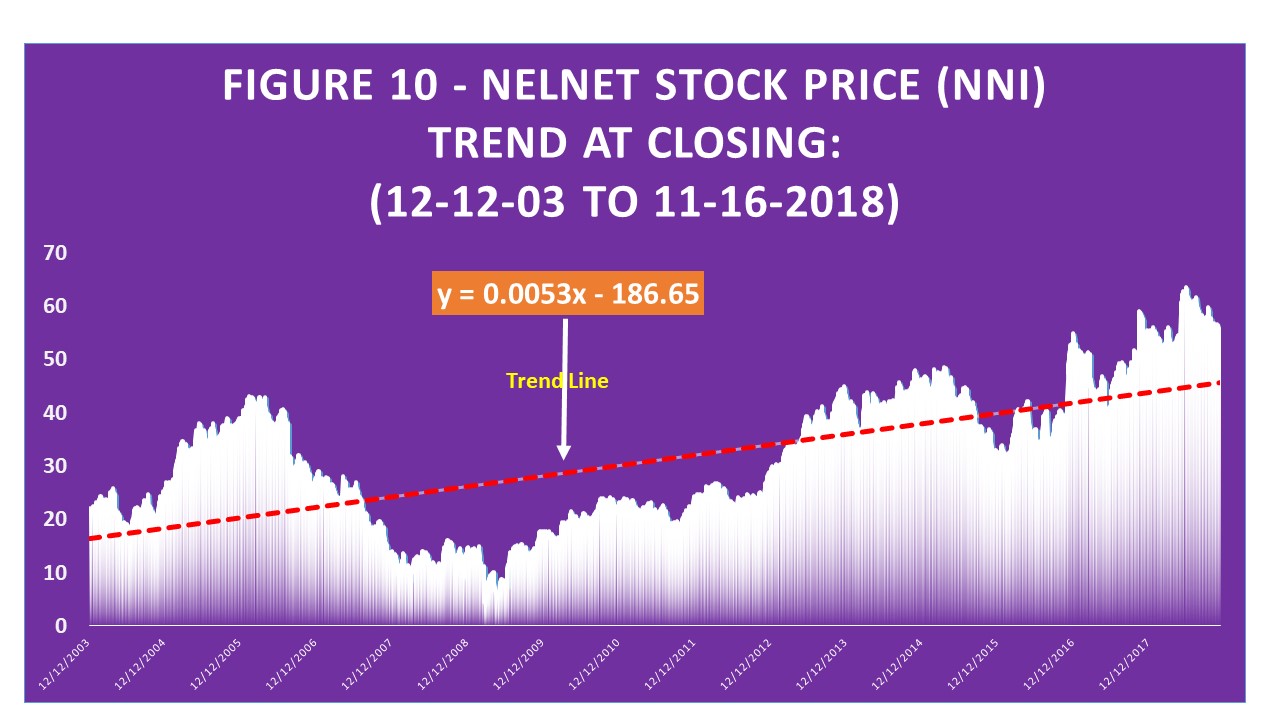

As of May 3, 2019, NNI stock price has increased about 269%, compared to the price on 12/12/2003. This implies NNI has met the Wall Street’s expectation well. But, on the other side of the coin may suggest the success is based on the loan borrowers’ labor and transferred wealth to the Wall Street. When one of the candidates announced her plan to wipe-out the student loan debt on April 22, 2019; the Market does not react at all, for it is still along ways before the plan becomes a reality.