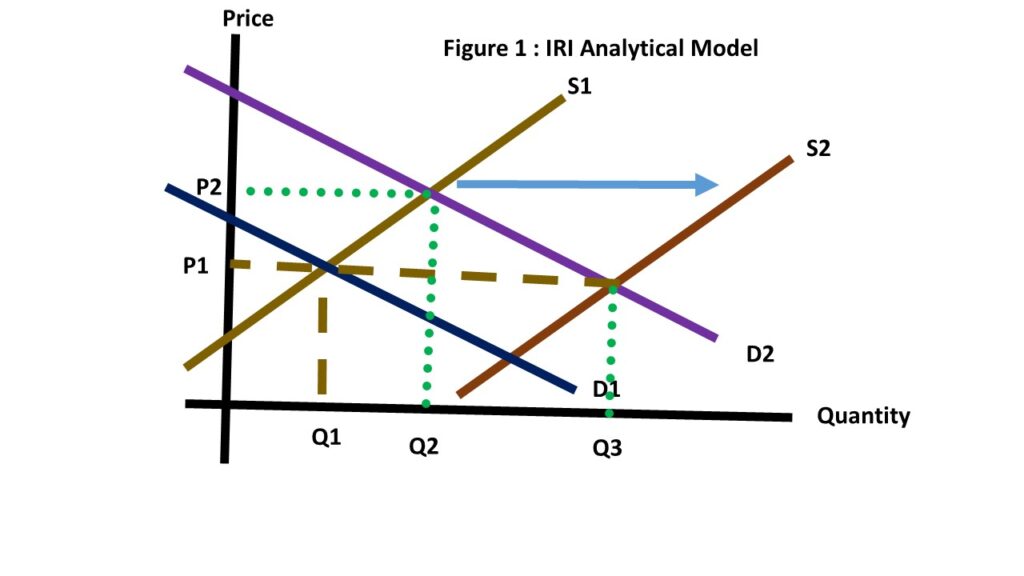

Frequent, if not 24 hours, the US media continually reporting how the inflation becomes a hot topic, and perhaps most likely to be the decision point of American voters. After watching a law grad student who was interviewed (with vague answers/ideas about inflation), by one of the networks, AAEA is motivated to shed the light on such issue. AAEA will help the voters to understand the problem in a simple graph, yet complicated enough for one that has not had economic 101 to comprehend what is presenting in this BLOG. Please look at the Figure 1 below.

Historically, the FED has set the interest rate pretty low to encourage consumers to borrow, and buy stuff, especially during the pandemic–which is justifiable. The results of such a policy were to move aggregate demand curve or line from D1 to D2, where D1 is the aggregate demand in absent of FED’s policy. Without market intervention, the general price is denoted by P1. After the FED’s intervention–that cause aggregate demand to increase as well as the general price from P1 to P2. This general increase, or known as inflation becomes the talking points of folks in the campaign trails. Unfortunately, most voters are illiterate about the causes-and-effects, such that they are badly manipulated. So, read our honest BLOG, and listen less to the ones that only have interest on your votes, and not on your well-being. So, the FED is trying to control the inflation, by increasing interest rate. However, the effects of this policy are:

- Higher interest rate meant to lower the aggregate demand for goods and services across the industry. Fortunately, Americans are able to cope with the price increase.

- Weaker demand for goods and services will cause the industry sector to suffer for over-production and increase operational cost due to inventory accumulation.

- Consequently of point#2 is that demand for labor will drop, and the end-results will be increasing UNEMPLOYMENT.

How can one keep the inflation under control without causing increase UNEMPLOYMENT. This can be done as expressed in Figure – 1 above by shifting the Supply line from S1 to S2. Yes, this is in theory, and in reality how can the industry sector has the incentives to invest, and expand its output from Q1 to Q3. This requires a team work from people with different colors in the society. One color alone won’t solve the American problem. Hopefully, the law makers will understand Figure-1 above, and start to work as a team.

When people have a job; they HAVE THE PURCHASING POWER–THOUGH WEAKER. But, if people are unemployed, and no income, they cannot afford to buy stuff, but have to rely more heavily on the government’s program. The Wall Street knows exactly this is the case–in that the FED cannot use the old strategies, wisdoms and rely on the old mathematical economic and simulation models 🙂 to deal with the new world economy without destroying the whole house (Read: US economy as a whole–by increasing interest rate). As results, the DOW increased by 748.97 points on Friday–October 21, 2022. America, it is your choice to make on November 8, 2022. Either to go unemployed & rely on food stamps OR employed & able to pay stuff at a higher price.