This morning we learned the administrator has revived the accrediting group for-profit colleges, despite of their low track record. Will it matter? May be. The public may need to read an exclusive report on this issue written by Senator Elizabeth Warren’s office. Please click here. This is just a classic example that shows how disarray the US education and public policy is. How dysfunctional the relationships among the US Executive, Legislative and Judicial branches are. When policies applied to benefit certain interest groups alone, it logically cannot be called a public policy. Rather, an interest group policy, for it does not represent the American public. That is how the logic works.

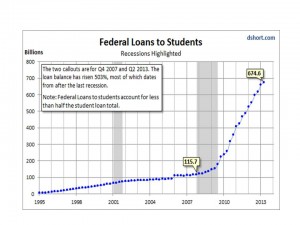

By now the American public has more knowledge about the effects of going to college and the potential of creating debts that some and because of a lower ROI (Return on Investment), may not be able to take them off their shoulder, ever. That being said, the impact may be minimal. However, there are certain population groups who may take the baits. If you care about your friends or family members and happened to visit the AAEA’s site or read articles in the BLOG, please share or forward the articles to them. You may save them from taking loans which they may not be able to pay them back for the rest of their life. Please click here for real life experience from others (One needs to scroll down to the bottom of the article).

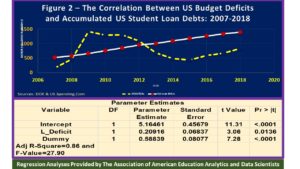

The current administrator’s policy again confirmed what the Association has hypothesized and found in its recent research. Systematic errors do occur and with this additional policy, perhaps, more of these kind of errors are (intentionally) infused in the system because of special interest groups, which may not necessarily represent the majority of the American public’s interest. Consequently, the student loan debts and its growth will accelerate as well in the near future.